GRATUITY OR EX GRATIA TO LEGAL HEIRS WHETHER TAXABLE Tax Planning for Salary TIPS BY MUKESH

Ex gratia payments are not taxable in India unless they are made in lieu of salary or wages. The amount of the payment is not limited, but it is generally based on the individual's or group's needs and circumstances. Features of Ex Gratia Payments. Ex gratia payments are voluntary and not required by law.

ExGratia Payment In Malaysia Ex Gratia Payment Letter Template Kabao Ex gratia payments as

According to the Tribunal, the payment was not in the nature of an ex-gratia payment or without there being an obligation on the part of the employer, as claimed by the taxpayer. The Tribunal was of the opinion that the payment was taxable within the meaning of Section 17(3) of the Act, which provides for the inclusion of compensation received.

ExGratia Payments by a Charity The Legal Lowdown

These ex gratia payment policy are taxable under federal tax and state tax laws in the US. · In India, these payments are taxable per slab rates applicable to an individual. If corporations receive such payments, then the A flat tax is a taxation system whereby a uniform tax rate applies to all taxpayers irrespective of their income.

Exgratia payment to kin of Covid victims under consultation Government

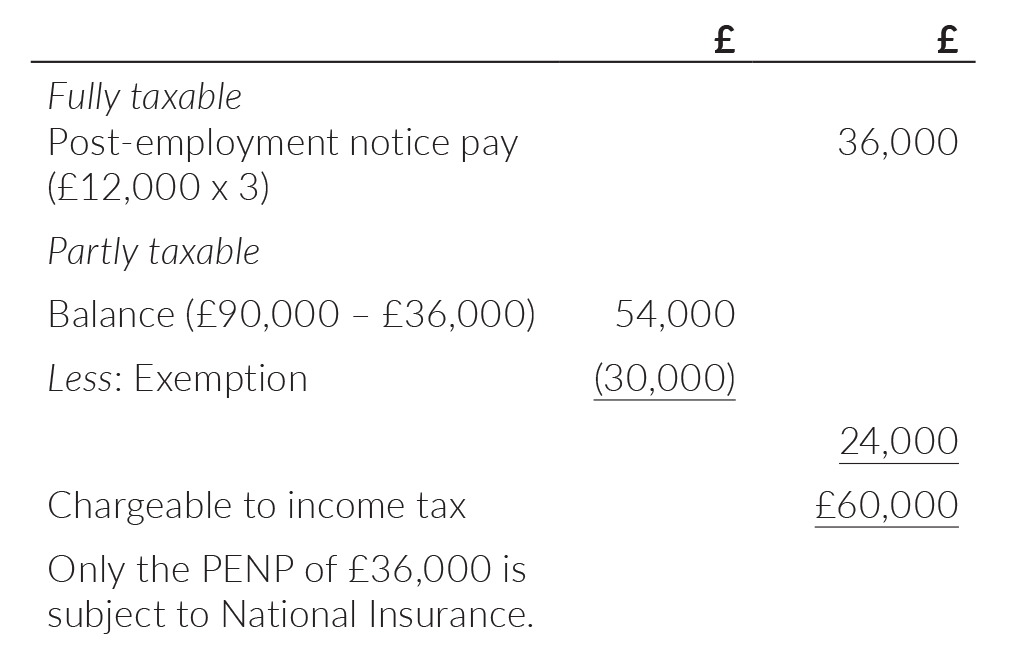

The following payments are not exempt from tax but may qualify for some tax relief: An ex-gratia payment: this is a non-statutory redundancy payment paid by your employer, which is over and above the statutory redundancy payment; Payment in lieu of notice: however, if this lump sum is paid under the terms of your contract, it is taxable in full.

:max_bytes(150000):strip_icc()/ExGratiaPayment-b1df6170df3b4f5698a0539226b83db6.jpeg)

What Is an Ex Gratia Payment?

Last updated on October 6, 2023. "Ex gratia" is a Latin term which translates to "by favour". An ex gratia payment is a voluntary payment made to an individual even though the party making the payment is not obligated to do so. Such payments are generally regarded as a gesture of goodwill to maintain good relations.

Ex Gratia Payment

However, a certain amount of ex gratia payments is tax-deductible in some countries. For example, in the UK, as long as the ex gratia payment is below £30,000 and is not for work or service rendered, it is not taxable. The amount beyond £30,000 will be taxed. Related Readings.

DIP Goa on Twitter "Clarification w.r.t. to grant of exgratia payment to the families of

These payments come under the employment contract. However, an ex gratia payment is an extra payment made by the employer, and such an amount without any legal obligation is not taxable. In other words, Ex gratia payments are not taxable in India, unless they are made in lieu of salary or wages. Ex gratia payment in Covid.

Ex Gratia Letter To Employee A Guide To Ex Gratia Payments I Michael Law Group Prisco Cremonesi

As you earn £1,000 per week, this means you would have earned £4,000 in taxable wages, making your PENP £4,000. You'll pay tax and National Insurance on the full £3,000 of your severance.

Ex Gratia Payment Entry In Tally Chapter I Objectives Objectives Of The Grants Ors Sections

Ex Gratia Payment: An ex gratia payment is made to an individual by an organization, government, or insurer for damages or claims, but it does not require the admittance of liability by the party.

ExGratia Payment to CPF Retirees who retired after 31121985 Appeal for removal of

Ex-gratia payments and tax. The government funds courtrooms and pays for tribunal judges, so it's in their interests to avoid such costs. In order to save these expenses, and reduce the likelihood of claims going to court, the government introduced a tax break on ex-gratia payments meaning that the first £30,000 is free of tax and National.

Ex gratia on termination of service taxable The Tribune India

Guidance on how ex-gratia payments are managed and resolved,. Income Tax and National Insurance contributions: treatment of termination payments; Tax on termination payments;

Presentation on FROM SALARIES ppt download

Hi All, can't find any confirmation whether tax-free £30k allowance for ex-gratia payments count or don't count towards total taxable income for the year, i.e. if someone gets £130k (including £30k ex-gratia), will other employment income in 2024/25 be taxed at 45% or there will still be 40% bracket available?

ExGratia Payment Received on Voluntary Retirement Not Taxable as “Profit in Lieu of Salary

Is ex gratia payment taxable? Generally, all the payments made by the employer to the employees are subject to taxation in India. These payments come under the employment contract. However, an ex gratia payment is an extra payment made by the employer, and such an amount without any legal obligation is not taxable. However, in the United States.

Ex Gratia Payment Letter Sample 8 Payment Request Letter Templates Pdf Free Premium Templates

Call us: 02033973603. Email us:[email protected]. Redundancy payments and ex gratia payments to employees. In redundancysituations you can receive the following sums as an ex-gratia payment: Statutory redundancy pay; and. Any lump sum compensation payment paid, subject to the £30,000 tax-free limit. To be clear, the £30,000 limit.

ExGratia Payment In Malaysia / An organization or a company voluntarily provides a payment to

Hello @Judy33. The additional ex-gratia payment is also known as a 'golden handshake'. Referring to the link below to Table A, the golden handshake payment is taxed at either 32% if the employee is under preservation age, 17% if preservation age or over, or 47% for any amount that exceeds the whole-of-income cap of $180,000.

Ex Gratia Payment or Contractual Entitlement?

An ex gratia payment is a payment made by your insurer for a loss that isn't technically covered by your policy. Learn more about this type of voluntary payment.. In some parts of the world, ex gratia payments have tax implications. If you get one from your insurance company, it's worth checking with a tax accountant to make sure you know.