Dorset Double council tax for second homes BBC News

Second home council tax changes in Scotland. Legislation passed in December 2023 allows local authorities to charge up to double council tax rates on second homes. The change will bring the second home council tax rules into line with long-term empty homes from April 2024.

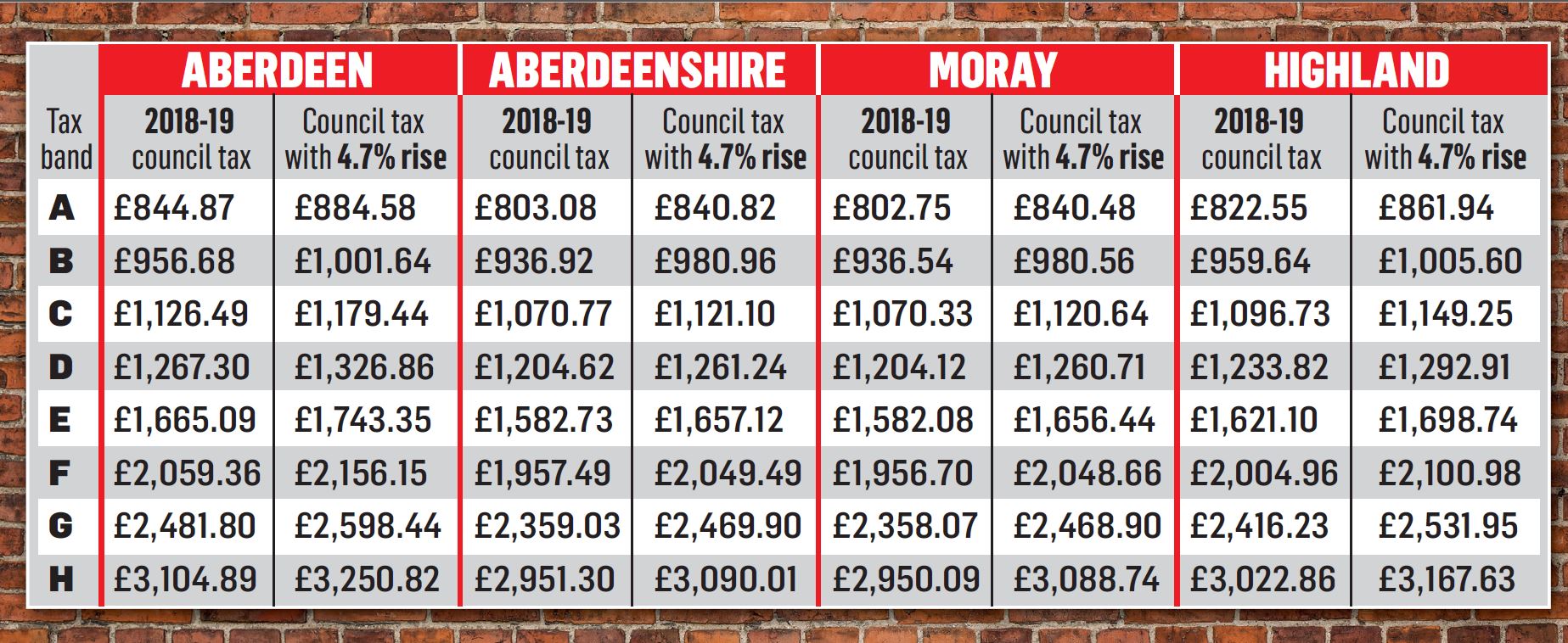

Four cent council tax rise agreed by Highland Council as leader says 'We've tried to be fair'

Under the Council Tax (Variation for Unoccupied Dwellings) (Scotland) Amendment Regulations 2023, councils will be able to increase the charges from 1 April 2024, with rates for the first year being based on those from 2023-24.. A second home is classed as any home that is not used as someone's primary residence but that is occupied for at least 25 days in a year.

Scotland set for rise in council tax as part of new budget deal

"With the purchase of second homes already subject to a 6% higher rate of property tax north of the border charging double the rate of council tax will ensure that fewer second homeowners will come to or remain in Scotland. Someone buying a £350,000 second home in Scotland already pays £29,350 in Land and Buildings Transaction Tax (LBTT.

Say 'No' to Labour's Council Tax Hike Sunderland Conservatives

The proposal, unveiled by the Scottish First Minister Humza Yousaf at the Scottish Trades Union Congress, would give local authorities the power to double council tax rates for second homes from April 2024. The changes will impact thousands of people who own more than one property in Scotland, and the news comes just weeks after most councils.

How to Avoid Paying Council Tax on an Empty Property VPS Guardians

Latest figures show that at the end of September 2022, there were 24,287 second homes in Scotland. Second homes are currently subject to a default 50% discount on council tax.

Council Tax rises come into force some can apply for Council Tax Reduction Personal Finance

From 1st April 2024 Orkney joined with the majority of other councils in Scotland by putting a Council Tax Surcharge of 100% on second homes. In Orkney there were 474 second homes in 2023. There were 252 long term empty properties in the islands. 201 of these properties had been empty for over 12 months.…

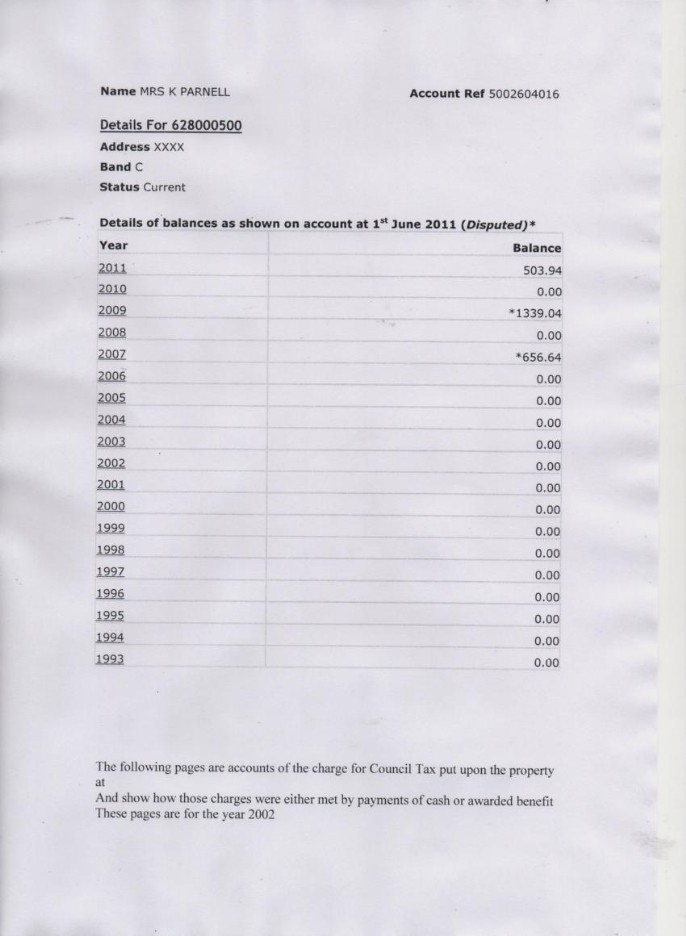

Fabricated council tax arrears Sheila Oliver's Campaigning Website

The proposal would bring Scotland's 24,000 second homes in line with long-term empty homes in the way council tax can be levied. A second home in Scotland is defined for council tax purposes as being nobody's main residence but occupied for at least 25 days a year.

Council Tax Benefit Calculator

The increase in council tax on second homes in Scotland mirrors similar measures introduced in England under the Levelling Up and Regeneration Act 2023, which allows councils to charge a premium of up to 100% on furnished housing not used as a sole or main residence. In Wales, local authorities have had the power to increase the rate of council.

EBillingCouncilTaxPosterENG Monmouthshire

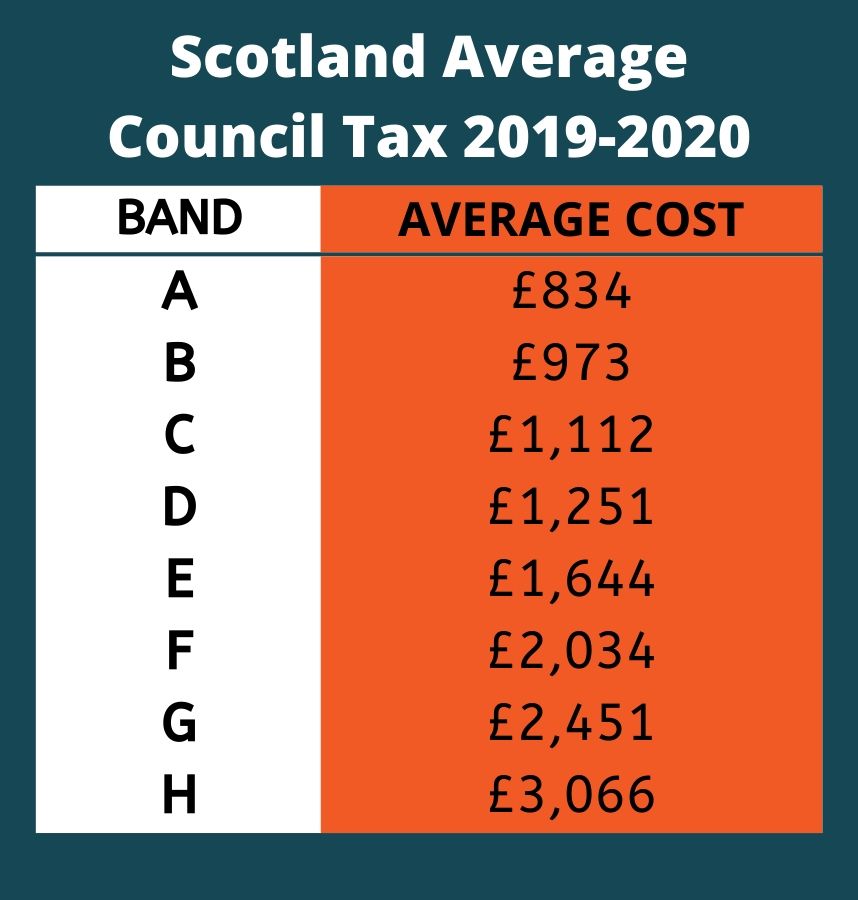

Latest figures show that as at September 2022 there were 24,287 second homes in Scotland. Second and long-term empty homes are subject to a default 50% discount on council tax. However, local authorities can vary council tax charges and the majority already charge second home-owners the full rate of council tax, the maximum currently permitted.

'We cannot rule out Council Tax increases' says Highland Council despite £120M of budget funding

Latest figures show that in January 2023 there were 42,865 long-term empty homes in Scotland.. councils to charge up to double the full rate of council tax on second homes from April 2024.

Croydon Council hikes council tax by 15 Dewbs & Co Public Content Network The Peoples

Scotland's councils could be handed the power to charge double council tax on second homes (Image: Archive) A CONSULTATION has found majority support for proposals to allow additional council tax charges for second homes in Scotland. The Scottish Government consultation received 981 responses, with 55% in favour of the proposals.

Council Tax International Student Support University of Exeter

The Scottish Parliament has approved new powers to increase the amount of Council Tax payable on second homes by up to 100% (double Council Tax). Read more about the new legislation. From 1 April 2024, Edinburgh will have a double charge for Council Tax (200%) for second homes. The change brings second homes into line with Council Tax policy on.

Moving House Council Tax The Ultimate Guide GoodMove

Share this story. New legislation passed in Scotland will see up to double the full rate of council tax charged on second homes. The regulations giving local authorities the power to apply the premium have been approved by the Scottish Parliament on Thursday. Previously, second homes were subject to a default 50% discount on council tax.

Council tax Wales could revalue homes for first time since 2003 BBC News

Councils will be able to increase the tax from April 1 under the new powers. 29 of Scotland's 32 local authorities have confirmed that second homeowners will have to pay the higher charge in their areas. Falkirk, Glasgow City and North Ayrshire are the only areas to have chosen not to double the tax. A second home is classed as any home that.

Council tax Second home owners could see council tax double following huge law change

MSPs will tomorrow start taking evidence on the Scottish Government's plans to allow local authorities to charge a council tax premium of up to 100% on second homes across the country from next.

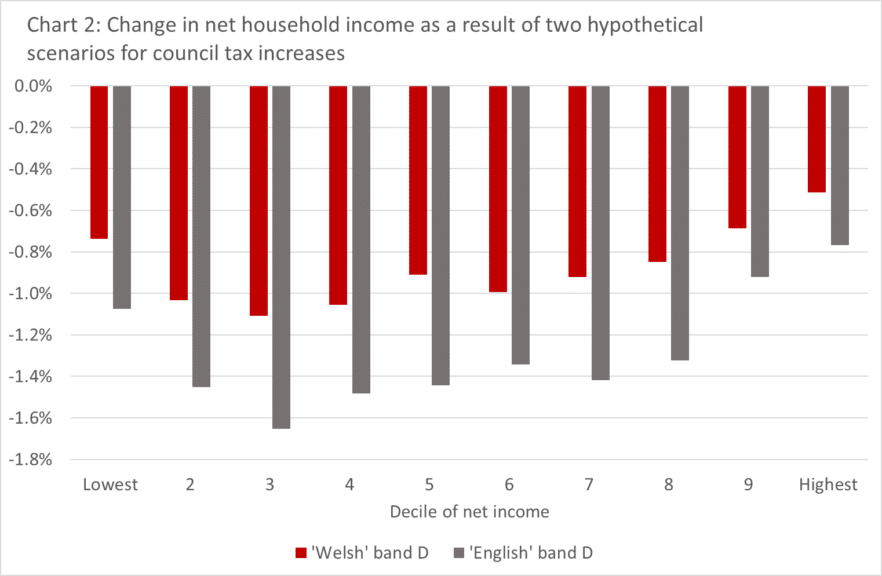

What is the case for increasing council tax rates in Scotland? FAI

Council tax statistics show that at September 2022, there were 24,287 second homes in Scotland. Overall, this is a low proportion, 1%, of all homes in Scotland. But there are wide variations across council areas with clear concentrations in rural areas (see below). Around 6% of homes in Argyll and Bute and in Na h-Elieanan Siar, 5% in Orkney.

- Brown Bread And Butter Pudding

- Christian Dior Clip On Earrings

- Mushroom Soup In The Soup Maker

- Montane Men S Terra Xt Pants

- Out Of Hours Doctors Barnsley

- How Much Does An Accountant Cost For Self Employed

- Best Night Vision Scope For Rats

- York Dungeon 2 For 1

- Nike Air Max 1 Shima Shima

- Toronto Blue Jays Baseball Cap